|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

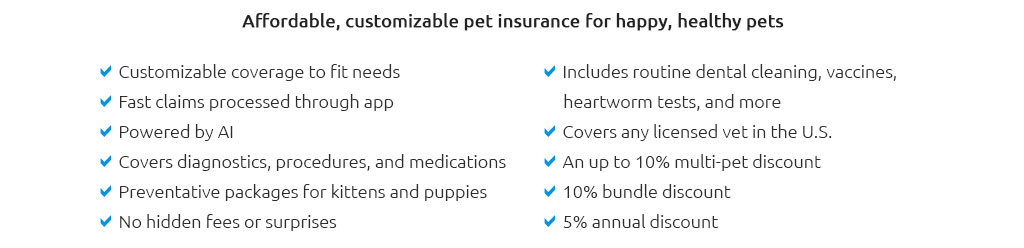

Understanding the Costs of Pet Insurance: A Comprehensive GuidePet insurance has emerged as an essential aspect of responsible pet ownership, offering financial protection against unforeseen veterinary expenses. As more pet owners recognize the benefits of insuring their furry companions, understanding the costs associated with pet insurance becomes crucial. The pricing structure of pet insurance can be complex, influenced by various factors that can significantly affect your premiums and coverage. This article delves into the nuances of pet insurance costs, helping you make informed decisions for your beloved pets. At its core, the cost of pet insurance is determined by several key elements. Breed is one of the primary factors influencing premiums, as certain breeds are predisposed to specific health issues. For instance, larger breeds may face higher premiums due to their susceptibility to joint problems, while purebreds often encounter more genetic health concerns. Additionally, age plays a critical role, with older pets typically incurring higher insurance costs due to the increased likelihood of health problems as they age. Another significant factor is the coverage level chosen. Policies with comprehensive coverage, including wellness visits, chronic conditions, and hereditary illnesses, tend to be more expensive than basic accident-only plans. Furthermore, the deductible and reimbursement rate you select can greatly impact your premium. A higher deductible often lowers the monthly premium but requires a greater out-of-pocket expenditure when filing a claim. Regional location also plays a part, as veterinary costs vary across different areas. Urban regions, where veterinary services are typically more expensive, may lead to higher insurance premiums. Conversely, living in a rural area might afford you lower rates due to reduced veterinary costs. While some might view pet insurance as an unnecessary expense, it can prove invaluable in providing peace of mind and financial stability. Veterinary bills can quickly escalate, and having insurance helps mitigate the financial burden, allowing you to focus on your pet's recovery rather than the cost of care. In assessing the value of pet insurance, it's essential to weigh the potential savings against the premiums paid over time. Some argue that a dedicated savings account for pet emergencies might be a more cost-effective solution, though this approach lacks the immediate coverage insurance provides for costly treatments. Ultimately, the decision to invest in pet insurance hinges on your financial situation, the health of your pet, and your risk tolerance. As you explore your options, consider obtaining quotes from multiple providers to compare prices and coverage levels. Many insurers offer customizable plans, allowing you to tailor the policy to suit your needs and budget. In conclusion, while the cost of pet insurance can vary widely based on numerous factors, understanding these elements empowers pet owners to make informed decisions. Whether you opt for comprehensive coverage or a more basic plan, pet insurance can be a valuable tool in safeguarding your pet's health and well-being. Frequently Asked QuestionsWhat factors affect the cost of pet insurance?The cost of pet insurance is influenced by the pet's breed, age, and health, as well as the level of coverage, deductible, reimbursement rate, and the policyholder's location. Is pet insurance worth the investment?Pet insurance can be a worthwhile investment for those seeking financial protection against unexpected veterinary expenses, though it depends on individual circumstances and the health of the pet. Can I customize my pet insurance plan?Yes, many insurers offer customizable plans, allowing you to adjust the coverage level, deductible, and reimbursement rate to fit your budget and needs. How does the location affect pet insurance premiums?Location affects premiums as veterinary costs vary by region, with urban areas often having higher costs than rural ones, impacting the overall insurance rates. What is the difference between accident-only and comprehensive coverage?Accident-only coverage typically costs less and covers injuries from accidents, while comprehensive coverage includes accidents, illnesses, and often wellness care, offering broader protection. https://www.cbsnews.com/boston/news/is-pet-insurance-too-expensive/

The agency said companies have blamed rate hikes on "evolving technology and increases in the costs of supplies." Harrison Stenson is the pet ... https://www.experian.com/blogs/ask-experian/how-much-does-pet-insurance-cost/

Pet insurance costs an average of $675 annually for dogs and $383 annually for cats. However, your pet insurance premiums may be higher or lower ... https://www.quora.com/How-much-does-it-cost-to-insure-a-dog-Is-pet-insurance-worth-it-for-dogs-or-cats

Generally, the cost of insuring a dog can vary widely, depending on factors like the dog's breed, age, and where you live, as well as the ...

|